THC potency, effect, and price dominate the decision-making process at retail counters in regulated markets, but the next generation of consumers is moving away from smoking as the primary method of consumption in search of a wider variety of manufactured products that can be openly and comfortably used in social settings.

New Frontier Data’s latest market report, Cannabis Trends in 2023: Products, Consumers, and the Impact of Prohibition on the Industry, explores cannabis consumer attitudes, perceptions, and consumption preferences across legal and unregulated U.S. markets. The report’s 35 pages of forecasts, analysis, and trends are developed from data points collected over 13 years, including an online survey of 5,534 individuals conducted from February 17 to February 26, 2023. Of the survey respondents, 4,358 were self-reported cannabis consumers while 1,176 identified as non-consumers.

According to the data, experienced and new consumers are branching out from flower as availability and preferences for manufactured products like vapes and edibles change. In 2022, 17 percent of consumers reported consuming edibles more frequently than any other form and 22 percent reported edibles as their favorite consumption method. Those numbers have increased by 24 percent and 14 percent, respectively. During the same period, flower use with a pipe or joint fell in both categories.

“We are seeing three big forces that are impacting the rise in edible consumption,” said Dr. Amanda Reiman (Ph.D., MSW), chief knowledge officer at New Frontier Data. “First, technology that is bringing fast-acting edibles to market is helping to overcome the biggest barriers to edible adoption: length of time to onset and fear of overdose. Second, even though cannabis is becoming more mainstream, the act of smoking is still prohibited in many places and smoking cannabis is tough to hide. Finally, legalization brings people into the market who have never used cannabis because they did not want to break the law, as well as people who are becoming medical patients. These consumers prefer non-smoked methods of consumption.”

According to Reiman, 71 percent of non-consumers who would be open to trying cannabis said they would choose edibles as their method of consumption. That number drops to 22 percent with flower.

While “flower-only” joints or pre-rolls still top the list of the most used and preferred product form across all age demographics, New Frontier noted a “slight dip [in the popularity of] higher-potency products like pre-rolls infused with concentrate and dabbing/smoking extracts.” According to the report’s authors, this new trend away from potency is most prevalent among younger consumers who were not subject to the “nuances of the illicit market” and may see flower as too smelly or difficult to use in social settings. Respondents in the 18-24 cohort were least likely to report exclusively using smokeable forms, highlighting a movement into manufactured product adoption among Gen Z consumers that’s expected to continue.

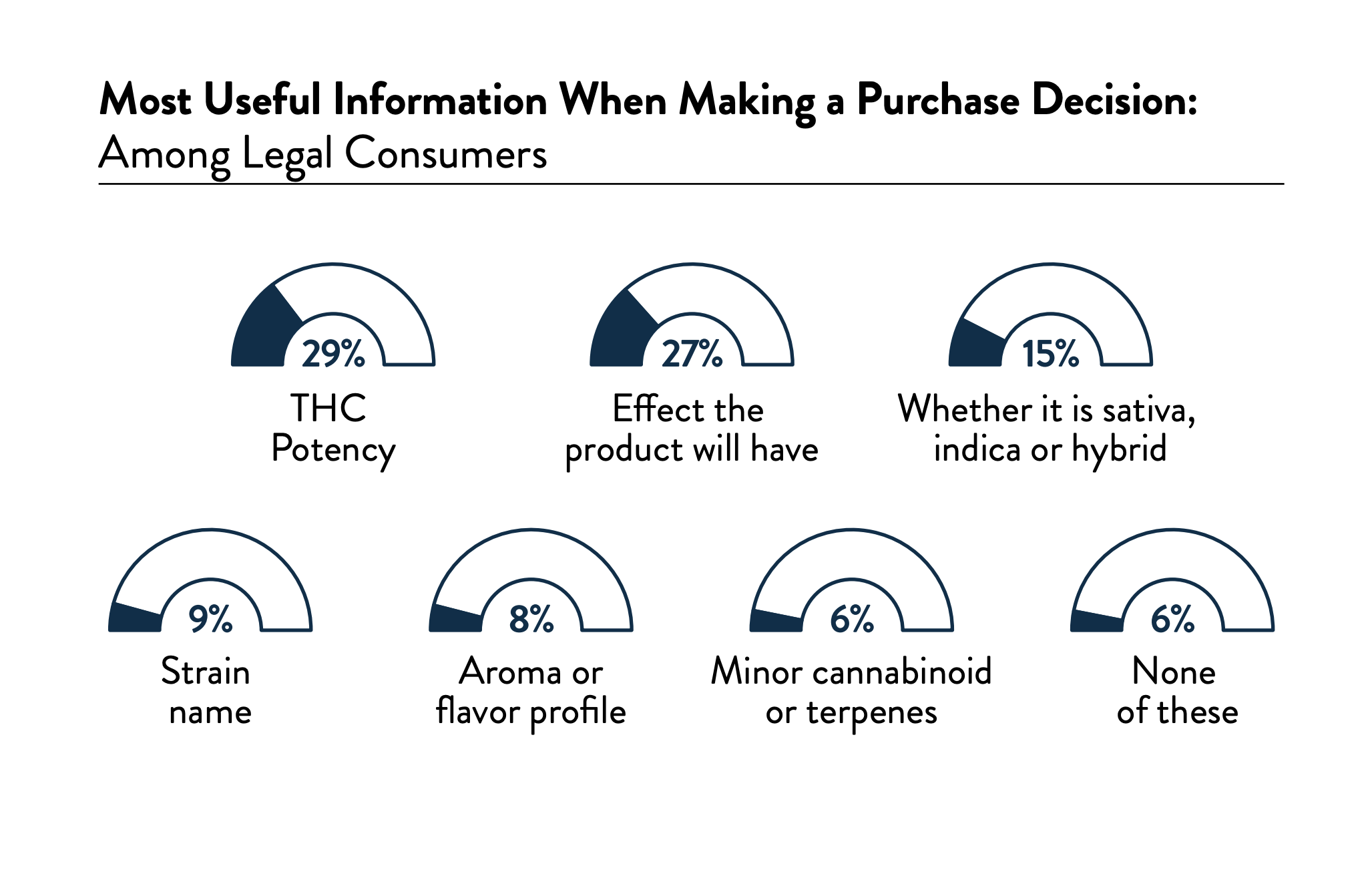

While the future for edibles and low-dose manufactured products looks bright, they’re still not the dominant factors for most consumers today. According to New Frontier Data, 40 percent of legal consumers say THC potency is extremely important while 37 percent note the same level of importance for the effect promised on the product’s packaging. Price is either very or extremely important for 64 percent of consumers, rounding out the trifecta of potency, effect, and price that’s “extremely important” for more than one-third of the marketplace in 2023.

Other factors including online product reviews, non-cannabis ingredients, and which company made the product are at best “moderately important” among legal consumers, but none of these factors played a significant role in the purchase decision for most survey respondents. Among all 10 of the product decision factors explored in the survey, the design of the packaging played the smallest role, with 38 percent of respondents saying it’s “not at all important.”

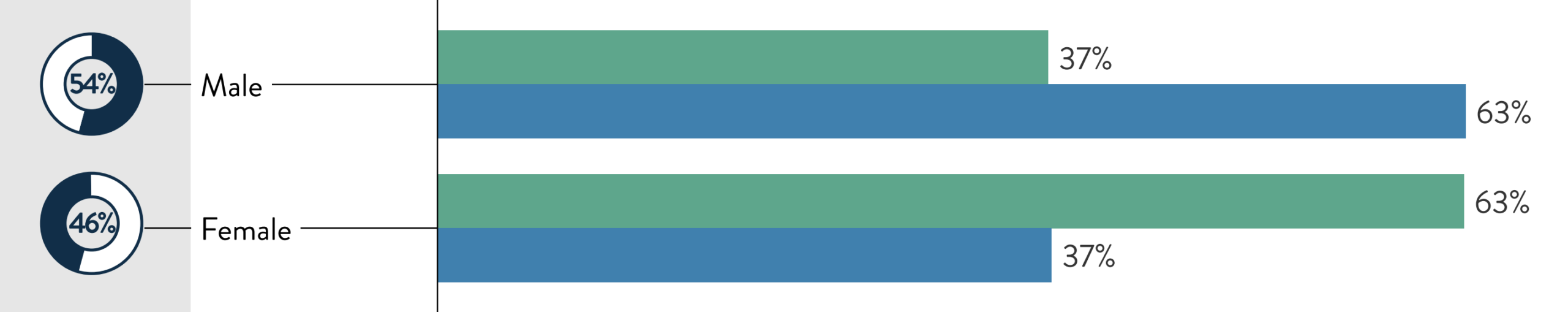

Perhaps the largest demographic disparity in New Frontier’s report is the difference between male and female consumers who exclusively use smoked forms of cannabis, pointing to a stronger stigma for female cannabis smokers and an opportunity for brands to provide attractive alternatives for this demographic. According to Reiman, there are a few reasons behind the disparity.

“First, women are more often the primary caretakers of children, or assumed to be,” said Reiman. “This means that their image and identity as parents are at risk when they are seen engaging in behaviors that society does not approve of for caretakers of children. Drug use is high on that list, as is smoking. Therefore, women take a higher social risk than men when smoking cannabis. Secondly, women are more likely to be using cannabis for medical purposes, and those who use cannabis for medical purposes are more likely to choose forms like topicals and tinctures. Finally, women are more interested in the effect a product will have and men are more interested in potency. This may make products like tinctures more attractive to women because they can dial in specific ratios of cannabinoids. When looking at the New Frontier Data consumer archetypes, based on our consumer survey, the ones who prefer non-smoked methods of consumption all lean female.”

A 2020 scoping review study published in the International Journal of Environmental Research and Public Health consolidates existing evidence from the academic literature about how gender norms, roles, and relations impact cannabis-use patterns. Looking at more than 20 studies, researchers found women experienced stigma when using cannabis during pregnancy and motherhood.

“Women who were parents of adolescents described being afraid of child welfare involvement and feeling hypocritical if they were using and hiding their cannabis use from their children,” according to the study. “In order to manage this, women limited where and when they used cannabis to avoid having their children and others knowing about it. The authors describe the women as internalizing stigma regarding their cannabis use and engaging in practices of ‘moral regulation’ to maintain their mothering role, as well as others’ perception of them as a ‘good mother.’”

While edibles are gaining ground in key demographics, a trend that’s expected to continue as Gen Z replaces older generations as the largest demographic group, high-THC flower—and particularly flower-only pre-rolls—remain the dominant product. In today’s retail environment, brands interested in casting a wide net, attracting new customers, and increasing sales should focus on potency, effects, and price, all of which are listed as “very important” by consumers.