Edibles are an invaluable segment of the cannabis industry. From classic THC-infused brownies to flavorful fruit-filled gems, edibles have captivated the imagination of medical patients and recreational consumers across all walks of life. In sports, former heavyweight foes Evander Holyfield and Mike Tyson transformed into friendly business partners through the development of their commemorative edibles offerings. In music, global superstar Calvin “Snoop Dogg” Broadus has turned his love for the plant into a vibrant collection of cannabis products, including fruit-flavored and savory treats.

Regardless of who they are or where they’re from, everyone appreciates how edibles add to the cannabis ecosystem. Nevertheless, regulators restrict how these products are distributed by licensed retailers. More specifically, edibles sales are subjected to a limit of no more than ten milligrams of THC per package in Canada. In the United States, regulations are a bit more relaxed but still stifle the number of milligrams of THC included in each package.

Contrary to current regulations, there is a growing consumer demand for relaxed limits across North America.

In Canada, edibles are substantially less popular than in the United States. With that said, tight regulation on the amount of THC allowed in each package likely contributes to the category’s comparatively low popularity. However, brands have worked around these regulations by offering products classified as “ingestible extracts,” which are allowed to contain significantly more THC per package.

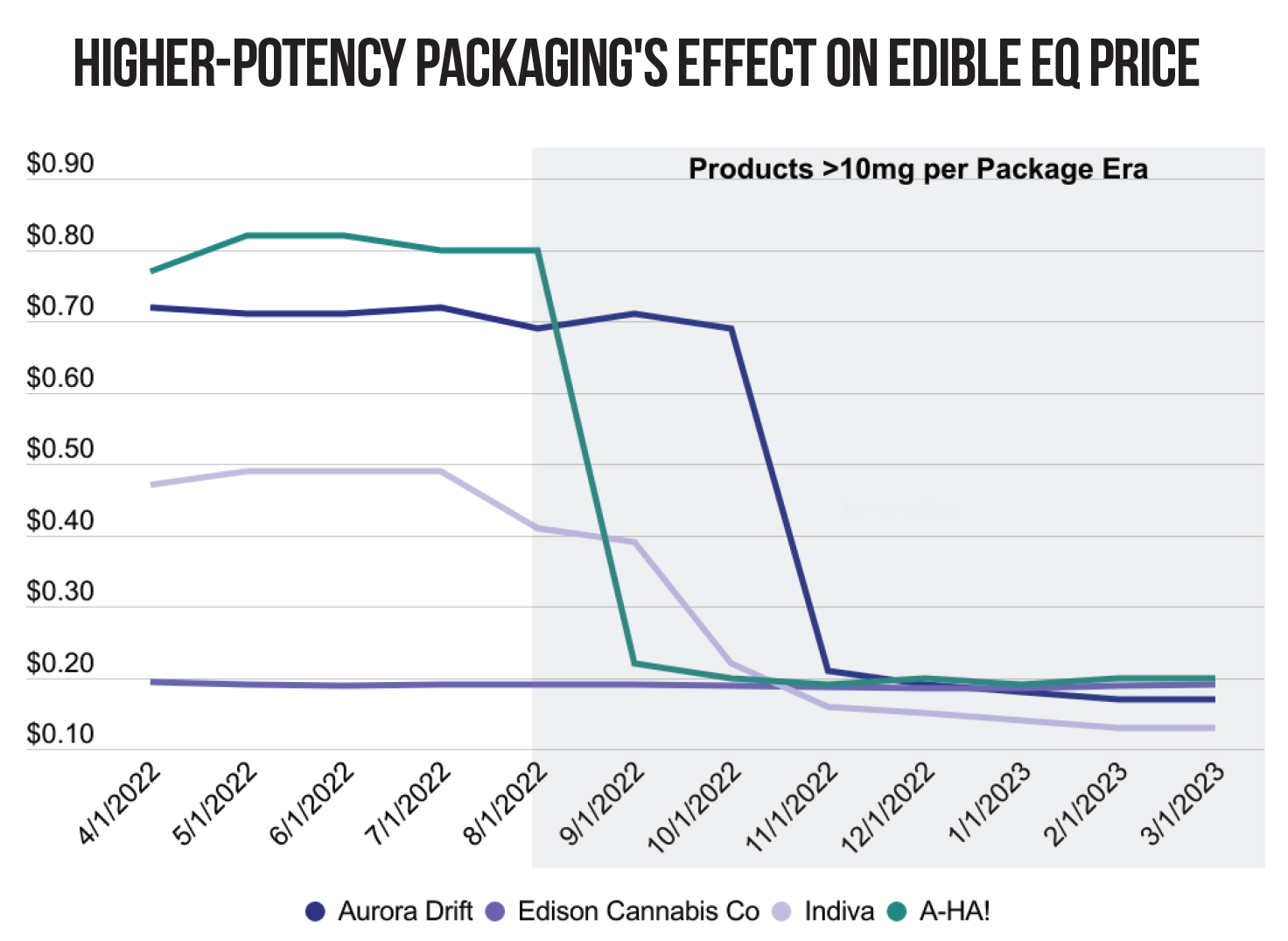

Thus far, ingestible-extract providers Aurora Drift, Indiva, and Edison Cannabis Co. have emerged as three of the ten most popular edibles brands in Canada. Furthermore, nine products from these three companies collectively accounted for 17.7 percent of all edibles sales from January to April 2023. As consumers continue to gravitate toward these brands, the trend has accompanied a sharp decrease in equilibrium (EQ) price, a metric that measures the price per milligram of THC. This decrease in EQ price has helped boost sales by supplying customers with more affordable options in their local dispensaries.

Consumers farther south also are flocking to more price-efficient options within the edibles category. In April 2022, policymakers in Oregon shifted the state’s THC-per-package limit from fifty milligrams to 100 milligrams. Before this policy change, packages with 50mg of THC made up 86 percent of edibles sales. By April 1, 2023, packages with 100mg of THC made up 78.3 percent of the state’s edibles sales. Relaxed regulations on the amount of THC offered in each package have allowed the product category to account for 12.4 percent of cannabis sales in the U.S., nearly double that of the Canadian market.

If one thing is clear, it’s that consumers desire high-potency product packaging. Thinking economically, it allows customers to get more product for their dollar. Thinking practically, it’s easier to walk out of a store with one package or bag rather than three or four. High-potency product packaging also benefits brands, as it drives sales within the edibles category in both the U.S. and Canada.

As policymakers in both countries move forward, consumers and retailers implore them to make data-driven decisions that will benefit all parties involved. After all, who doesn’t enjoy a THC-infused treat along their cannabis journey?