The world changed in March 2020 when, in response to a killer pandemic that rapidly overwhelmed the American medical system, the United States literally closed. Everyone except first responders and other essential personnel was ordered to stay at home. No school. No shopping. No outside-the-home entertainment or public gatherings. Once-bustling cities became ghost towns overnight as citizens barricaded themselves inside their homes in an effort to avoid a deadly plague.

Because people still had to eat and replenish necessities (toilet paper, soap, hand sanitizer), essential businesses were allowed to shift their operations online and run skeleton crews to deliver merchandise or provide curbside pickup service. Cannabis was declared an essential business in many communities because so many residents had come to rely on its medicinal properties.

Dispensary owners everywhere hastily dusted the cobwebs off their neglected websites. A handful of ecommerce menu providers, third-party directories, and delivery services helped brick-and-mortar stores get their ships in order almost overnight while scaling their own operations on the fly.

“Like restaurants, retail had been largely the same for thousands of years until all of a sudden it changed really quickly,” said Dutchie Chief Executive Officer and Chairman Tim Barash, who previously served as chief financial officer for cloud-based restaurant-management tool Toast. “Suddenly cannabis commerce is changing at this breakneck speed, and we were just trying to help our customers stay ahead of the curve.”

Today, about 50 percent of the industry’s transactions take place online, up from less than 20 percent pre-pandemic. This represents a considerable shakeup in how consumers find and buy cannabis. Almost all dispensaries now have an online menu tethered to their point-of-sale system that enables browsing, pre-ordering, or reserving inventory, with local delivery or in-store pickup as fulfillment options.

But as we all know, nothing is simple in this highly regulated industry. Not only are cannabis companies constrained as to how they can acquire new customers and forced to jump through hoops to process transactions online, but complex state-by-state regulations have forced the industry to develop its own parallel economy of software-as-a-service (SaaS) tools.

“In other ecommerce industries, the vendors—Shopify, WooCommerce—are pretty mature,” said Andy Cho, newly appointed chief digital officer at multistate operator (MSO) Ayr Wellness. “In our industry, you have all these cannabis-specific tools for your ecommerce, marketing, and data stacks, each with their own pros and cons, and on top of that you have different state-by-state regulations on delivery, order-taking, and payments. It’s a struggle to do nationally.”

Cho previously oversaw ecommerce for luxury jeweler Tiffany’s. His ecommerce-focused C-suite role at Ayr, which may be unique in cannabis, speaks to how essential the company considers digital sales platforms.

Ayr is far from alone in taking ecommerce more seriously. In its most recent earnings report, Cresco announced it had surpassed $1 billion in online retail sales solely through the company’s ecommerce platform, Sunnyside. This averages out to approximately $37 million per month. A recent job posting from Green Thumb Industries noted the MSO’s ecommerce program processes $400 million per year.

“Your website is your largest store,” said Jeremy Johnson, head of business development for Dispense, a menu provider that focuses on developing search-engine-optimized assets. “Your website has the potential to scale exponentially in ways that cannot be matched by physical retail.”

This dynamic, where the retailer drives business through its own website, is relatively new in cannabis. Until Jane Technologies brought the first off-the-shelf solution to market in 2017, Weedmaps had been the primary way retailers connected with consumers online. Dispensaries would—and still do—pay Weedmaps a listing fee for a spot in the digital marketplace, where they then could benefit from being available on one of the industry’s most-trafficked websites. (The company reported an average of 5,641 monthly paying clients in its Q1 2023 earnings.)

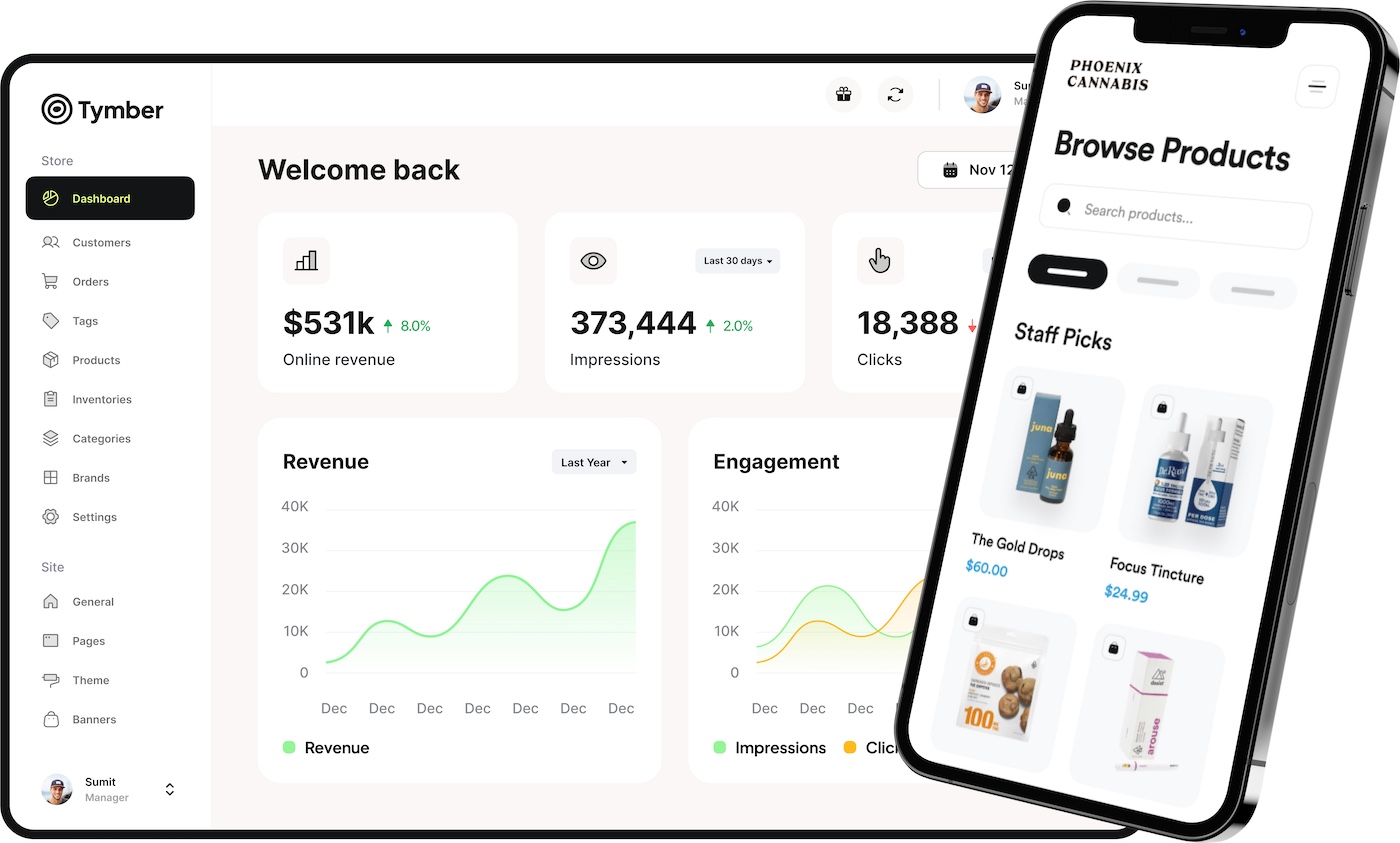

“Back in the pre-recreational days, you’d just get a Weedmaps account, pay for advertising, and the phone would ring,” said Scott Roehrick, vice president of ecommerce for Blaze and founder of SaaS ecommerce provider Tymber (which Blaze acquired in January 2023). “Cannabis retailers back then didn’t have [a digital] asset. They had a profile on someone else’s website. If you stopped paying the provider, the phone would stop ringing. That needed to change.”

Jane co-founder and CEO Socrates Rosenfeld, who at the time was working toward a master of business administration degree at the Massachusetts Institute of Technology after spending seven years in the U.S. Army, saw an immature industry that looked more like the restaurant business than what we consider traditional ecommerce. Inherent within that situation was a major opportunity.

“You had offline retailers, largely fragmented mom-and-pop operations with no ability to ship directly to consumers,” he explained. “Companies like Amazon, Shopify, Uber, and Doordash weren’t entering the space, so we had to literally invent a new way for ecommerce to be done.”

Dutchie launched to address the same problem shortly afterward, and Weedmaps and Leafly later created embeddable versions of their marketplace menus for dispensaries to host on their sites. The vast majority of dispensaries still use one of these four solutions, though the providers now have credible competition from upstart ecommerce providers like Dispense, Tymber (via Blaze), and Sweed.

In the past, a handful of forward-thinking retailers built more custom solutions, like Airfield Supply and Eaze. The latter began as a delivery-driven ecommerce marketplace and has morphed into a vertically integrated MSO with a proprietary enterprise resource planning platform and delivery system at its core.

“When we launched in 2014, there just weren’t off-the-shelf options,” said Eaze CEO Cory Azzalino. “We are moving to that now because there are good, specialized providers that have the time and resources to continuously focus on developing their products.”

Overcoming Limitations

The roadblock of being unable to accept credit card payments looms large as the defining challenge for cannabis ecommerce. The majority of “online sales” are in fact preorders: The customer reserves the product and pays at the store or with the delivery driver, often in cash or via a cashless ATM that typically applies an additional charge.

Automated clearing house (ACH) payments, whereby the customer connects a bank account through a third party, have emerged as a workaround, though they are far from perfect and allow connections only for debit cards.

In mid-2022, Dutchie launched an online ACH payment solution that integrates with its ecommerce menu. The company says about a quarter of its 4,000 clients offer digital payments to their customers.

Jane works with Aeropay, a Chicago-based financial technology company that provides secure bank-transfer payments. While the platform does enable non-cash online payments, it’s still considered a mere step on the path toward the ideal of accepting digital payments like any other ecommerce platform.

“This is the biggest limitation with cannabis ecommerce,” said Rosenfeld. “When we can process credit cards and take a percent of every transaction we process, then things get very interesting for us as a company.”

With payment-processing challenges facing everyone in the industry, one of the big variables dispensaries are exploring to obtain an edge over competitors is how to make their websites—specifically, their menus—more search-engine-friendly.

“There are more than 12.5 million searches per month for dispensary-related terms,” Johnson wrote on LinkedIn, where he regularly shares his analysis of search engine optimization (SEO) and ecommerce. “‘Dispensary near me’ is the most searched for by far, at 1.8 million searches per month.”

Dispense and Tymber specifically assert dispensaries should place a premium on SEO in order to rank for searches relating to dispensaries, strains, or brands. They argue standard iframe menus from Dutchie, Jane, and Weedmaps help the providers, not dispensaries, rank for popular terms.

In the simplest terms, an iframe is a website within a website. The URL may say “MyDankDispensary.com,” but because the menu section actually is hosted on the provider’s server and has a separate, invisible URL, search engines credit to the provider every word, image, and tag relating to the products—and all of those assets are increasingly valuable from an SEO perspective.

“Iframes are in the best interest of the menu provider, not the retailers,” said Roehrick, who developed Tymber after multiple dispensaries asked his agency for the same thing: something between a high-dollar custom site and a $200 iframe. “We wanted to create a native ecommerce platform that outranks the marketplaces and iframes and gets dispensaries the benefit of having a big custom site but for a fraction of the cost.”

Dispense also built its product in response to the limitations of iframes. The Boston-based company claims to produce better organic search traffic than its bigger rivals and touts that among the reasons—which also include potentially increasing sales and building long-term value in search-engine-related domain authority—to pay Dispense’s higher monthly fee.

“If you take [MSO] Ascend as an example, before working with us, their in-house brand Ozone didn’t rank on Google at all,” said Johnson. “In the first 100 days, we drove $210,000 in revenue from searches related to Ozone. That was all traffic that was going to Weedmaps or Leafly.”

Both Johnson and Roehrick say consumers now search for brands and specific strains, and native menus allow dispensaries to capture those searches. In contrast, iframes allow the providers to capture those customers (and the data they generate).

“If I search for ‘Stiiizy Sacramento,’ the first result that comes up is [a dispensary called] Humble Root, which uses Tymber and Blaze,” Roehrick said. “That comes above Stiiizy’s website, above Dutchie.com, above Weedmaps.”

As more and more retailers opted for native, SEO-friendly menus, Dutchie, Jane, and Weedmaps took note and adjusted their products to offer SEO benefits that rival Tymber and Dispense.

“We opted for iframes initially because they gave us speed to market,” said Rosenfeld. “About a year ago we created Jane Boost, the non-iframe version of our menu that utilizes our universal product catalog, which is 1.6 million [products] organized extremely well and is crawlable by Google.”

Dutchie took a similar path with its ecommerce menus. Recognizing the unindexable iframe was no longer fit for purpose, the company modified its core product to offer every client a significantly more SEO-friendly menu.

“Basically, when the Google [web-crawling] bot shows up on a website that is using the Dutchie embedded menu, we actually can detect that, remove the iframe, and replace it with the content from inside the iframe,” explained Chris Ostrowski, Dutchie’s chief technology officer. “What that gives you is first-party content and first-party indexing.”

Perfecting the customer experience

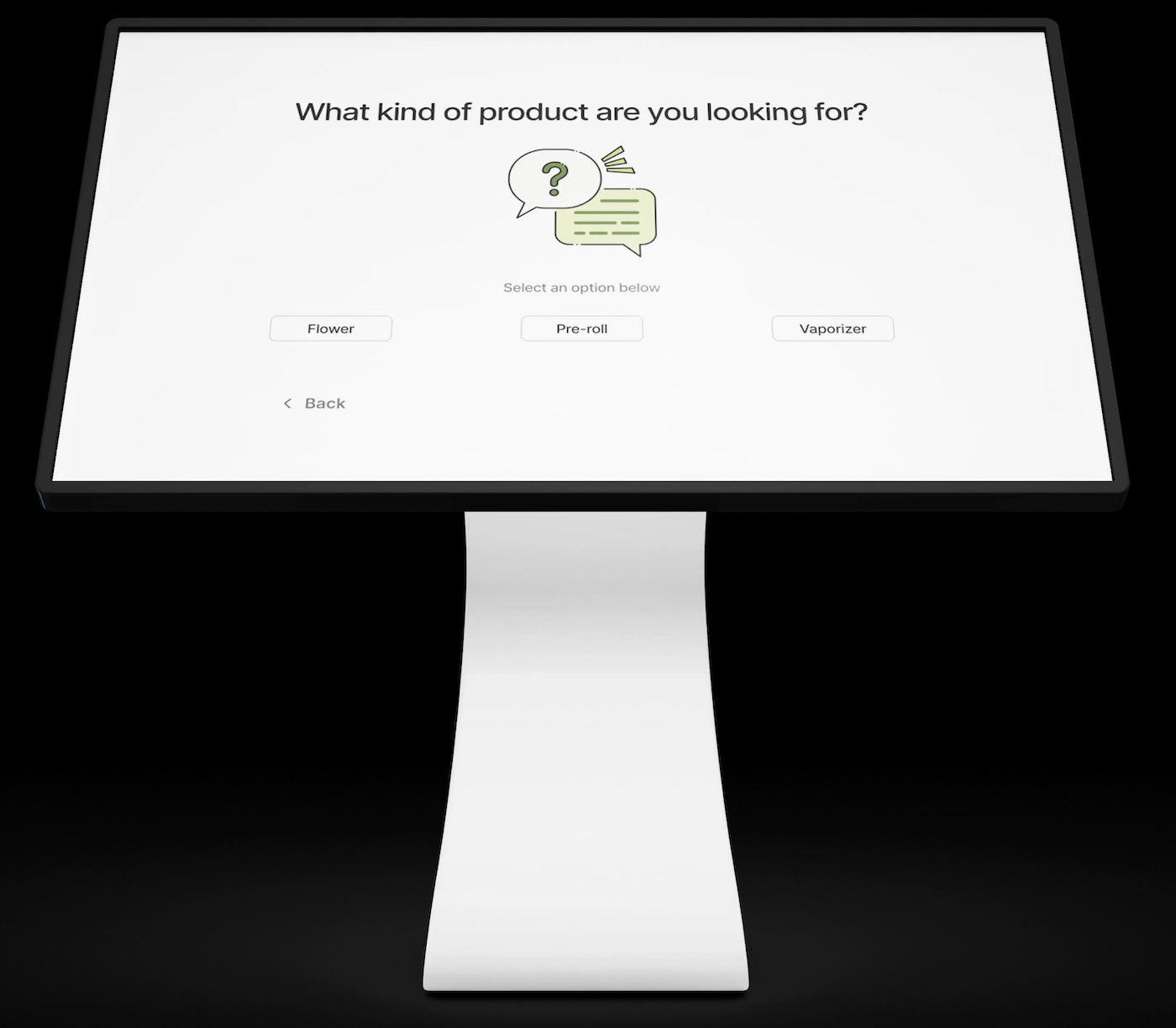

Getting potential consumers to visit a website is one thing, but connecting them with the right products and maximizing their basket size presents a whole different set of challenges. Physical stores have found budtenders play an essential role in this aspect of retail, particularly for new consumers, and ecommerce menu providers currently lack a budtender equivalent.

“Buying cannabis online, particularly for the first-time consumer, is really confusing,” said Andrew Leber, founder and CEO of StrainBrain, an artificially intelligent (AI) budtender that connects with ecommerce menus. “There are hundreds, sometimes thousands, of SKUs, and they’re presented in rows that commoditize them and encourage shopping on price. The lack of a budtender to guide you hurts the experience.”

Budtenders emerged as product consultants for a reason: Product options are overwhelming and the consequences of a wrong selection can be serious, particularly for new consumers. A bad first experience may mean they never try cannabis again, and this is a fundamental risk with unaided ecommerce browsing.

“I spend a lot of time thinking about this,” said Rosenfeld. “Technology is not a replacement for the in-store, human-to-human consultative experience. It will never replace that. I still want to talk to a human being if I’m uncertain.”

AI budtenders have emerged to address the problem. The tools act as a widget that is tethered to the ecommerce menu on the website, guiding shoppers with a simple flow of questions that whittle down the menu to a short, curated list.

“Our more than 200 retail partners are seeing incredible results,” said Leber, who developed StrainBrain after turning down an opportunity to earn a PhD in artificial intelligence at Oxford. “They’re increasing basket size by an average of 25 percent, seeing a 20-percent lift in conversion, and seeing overwhelming customer satisfaction across the board.”

According to digital consulting firm TA Digital, “80 percent of customers believe AI-powered chatbots assist them in making better purchase decisions than humans.” And cannabis, with its obfuscated terminology and poorly differentiated products, is perfectly suited for AI-assisted shopping.

The major platforms are waking up to this opportunity to varying degrees. Jane, for example, is developing a virtual budtender that will integrate seamlessly with the company’s menu and point-of-sale system and draw on the more than 2 million verified customer reviews on the platform.

“Social proof is so powerful,” said Rosenfeld. “If you think about how you’ve purchased anything online, if a product has thousands of good reviews, you’re going to buy it and feel pretty confident about your purchase.”

Weedmaps reportedly explored building a virtual budtender of sorts in the past, but the project was discontinued. However, the company has been actively applying machine learning to its vast repository of consumer data in an effort to improve the user experience (UX) and product recommendations.

“While we’ve had a front-row seat to consumer shopping behavior since our inception in 2008, we began analyzing this data across dozens of dimensions years ago,” said Randa McMinn, Weedmaps’ chief marketing officer. “We began testing machine learning to better personalize the menu sort, search, and recommended carousels in our marketplace in early 2022.”

Ayr’s Cho aims to create a three-layer structure for Ayr’s customer journey. At the bottom is a simple browsable menu (currently provided by Dutchie), the middle groups together inventory based on preferences, trends, or deals, and the top features a fully personalized experience, perhaps via an AI chatbot. “If we execute that stack correctly, every type of customer should be able to get exactly the right level of the guidance they want,” he said.

These developments in UX and AI also should be a boon for brands, which are keen to establish better returns on digital spend. Increasingly, ecommerce providers are creating opportunities for brands to advertise within stores’ digital menus.

Of the menu providers, Jane has built the most sophisticated brand-facing tech. In addition to the standard banners and carousels, the company offers a programmatic solution that allows brands to bid to show users their products. This feature arose after the company determined shelf-buys in dispensaries and generic banners on ecommerce menus are imprecise vehicles for advertising.

“If I get shown an ad for gummies but I’m a flower consumer, that’s a waste of money on the part of the gummy company,” Rosenfeld said. “Our data about the consumer’s preferences means we can serve them ads they are more likely to engage with, and we have an unlimited number of digital shelves to place that ad on.”

Dispensaries that opt into the advertising program share the ad revenue with Jane. According to Rosenfeld, the fifty highest-volume online stores generate between $1,500 and $5,000 a month. Brands buy the ad inventory directly from Jane, and the retailers have no say over what ads appear on their pages.

Dutchie has yet to offer a brand-facing ad solution, but the company insists if it does introduce such a product, it will place more control in the hands of participating retailers. “We want to make sure it’s retailer-first, it’s notably transparent, and it’s consensual on all sides of the transaction, which I think is not what you see in every case right now,” said Barash. “We’ve built a company with retailers in mind. They are our constituency, and we want to make sure that’s who we optimize for.”

Weedmaps has allowed brands to buy ad space since the company’s earliest days, and its offering gradually has expanded beyond the standard homepage carousels and banner ads. “Merchandising is an important part of our marketplace optimization, and we currently have a number of features in the works that are aimed at improving the user experience for consumers while also improving conversion rates for our clients,” said McMinn.

“Our marketing strategies go well beyond competing for search terms,” she added. “We use a variety of marketing channels to find high-intent users who convert in-store for our retailers and brands. Since Weedmaps doesn’t touch the plant, we have access to more channels than our plant-touching clients.”

The future of brand advertising in digital retail environments may end up looking a lot like StrainBrain’s new ad product. The AI chatbot offers SKU recommendations along with a corresponding percentage match, giving brands and consumers a considerably more targeted, personalized ad. The experience is something akin to incentivizing a responsible, extremely well-informed budtender.

“We’re seeing a ten-times return on ad spend, which is higher than you’d get on Instagram for a non-cannabis product,” said Leber. “At one store, we took a vape brand from sixth in the category to second in two weeks with no discounting.”

Envisioning the big picture

It should be clear by now that every dispensary can benefit from placing a greater emphasis on its digital store. Even if customers aren’t converting by placing an order online, they may check out the menu and then visit the associated brick-and-mortar location to buy. Poor discoverability or a lackluster user experience hurts in either scenario.

The challenges associated with processing transactions online will continue to hold ecommerce back from its potential. ACH solutions like Aeropay and Dutchie Pay are certainly helpful, but after Mastercard announced a complete prohibition on cannabis transactions, the future of workarounds for traditional payment methods remains somewhat murky.

If and when the payment problem resolves, marketplaces like Weedmaps and Leafly could pivot from charging retailers listing fees to taking a cut of transactions, which could better align incentives. Until then, a significant chunk of their value to retailers will remain their ability to draw organic traffic, though organic traffic to both Weedmaps and Leafly has declined by about 50 percent over the past two years, according to website-marketing tools provider Semrush.

Dutchie and Jane offer very similar core products, and both now offer point-of-sale systems for dispensaries looking to house everything under one roof. It’s hard to overlook the revenue split Jane offers on its brand advertising, which can amount to hundreds of thousands of dollars per year for the biggest MSOs. AI budtenders with advertising technology built in could provide the other platforms with a quick fix for that.

SEO ought to be a priority, particularly as Google appears to skew more heavily toward local search results. Every provider claims to deliver superior results, so spend time digging into their claims and speaking to real customers as opposed to just reading preselected case studies. An investment in SEO is an investment in the long-term health of a business.

There’s no doubt ecommerce presents consequential decisions for dispensary owners. Some may prioritize the convenience of working entirely with Dutchie, Jane, Weedmaps, or Leafly, while others may feel they can garner meaningful improvements in margin while supporting a small business like Dispense or Tymber.

With ecommerce influencing such a significant chunk of sales, it’s long past time for dispensaries to give the technology the attention it deserves.